Revolutionize your organization. Start with the steps that will add the most value

Sustainability. Digitalization. Customer perception. Where to start? You will never really finish, that's for sure. But you can improve every day—by converting daunting aspirations into manageable, data-driven actions. In this long read, we break down some of the biggest issues facing asset managers. And recommend immediate steps your organization can take towards a more efficient, resilient future.

Select your sector to jump straight to the big issues in your industry:

Or keep scrolling to keep reading.

Energy

Get sector specific insights and actions to consider, based on Arcadis Gen’s experience in the energy industry.

Water

Get sector specific insights and actions to consider, based on Arcadis Gen’s experience in the water industry.

Select a sector or keep on scrolling.

A big idea demands a step-by-step strategy

Read on for our overview of the big issues in asset management, and the steps organizations can take now to become more efficient, resilient, and sustainable—in more manageable ways.

Sustainability. Quite the buzzword and one that asset managers can’t ignore. Net zero. The Biden administration is prioritizing it. The UK wants it. Organizations are working to deliver it. Decisions haven’t been purely financial for a long time, and rightly so. Alignment to ESG principles doesn’t just make good environmental sense, it makes good economic sense too, as evidenced by Larry Fink’s 2021 letter to CEOs.

The UN’s Sustainable Development Goals (SDGs)—and your organization's alignment to them—are issues impacting and increasingly concerning your employees, customers and stakeholders. In fact, the US sustainability market is projected to reach $150 billion in sales this year, according to Nielsen—a customer awareness and mindset that they will increasingly extend to their utilities providers.

The evidence on climate risk is compelling investors to reassess core assumptions about modern finance. Research from a wide range of organizations... is deepening our understanding of how climate risk will impact both our physical world and the global system that finances economic growth.Source

In delivering on any goals, including those set out in the UNSDG, we know that borrowing and building on best practices is essential to certainty of outcome and accelerating the journey there. The principles and practice of Asset Management lend themselves well to building resilient and sustainable infrastructure—what we do is at the heart of this progress. Our work is relied upon to provide clean water, sanitation and energy to communities around the world.

So you know you need to be sustainable. It’s critical to strategy, to communities, to shareholders. But how do you begin to operationalize such serious, substantial commitments?

Read the sustainability action plan

Not net, yet

Net Zero. It’s a big ask. And fairly overwhelming to comprehend. Break it down into its component parts. The Greenhouse Gas (GHG) Protocol offers a good place to start, which considers how organizations can look holistically at their carbon emissions internally and across the supply chain, from both CapEx and OpEx perspectives.

- Scope 1: direct emissions from owned or controlled sources.

- Scope 2: indirect emissions from the generation of purchased electricity, steam, heating and cooling consumed by the reporting company.

- Scope 3: all other indirect emissions that occur in a company’s value chain.

Although not currently required in reporting and disclosing GHG emissions, measuring and considering Scope 3 is especially important, as most opportunities for reporting companies to significantly reduce emissions lie outside of their own organization.

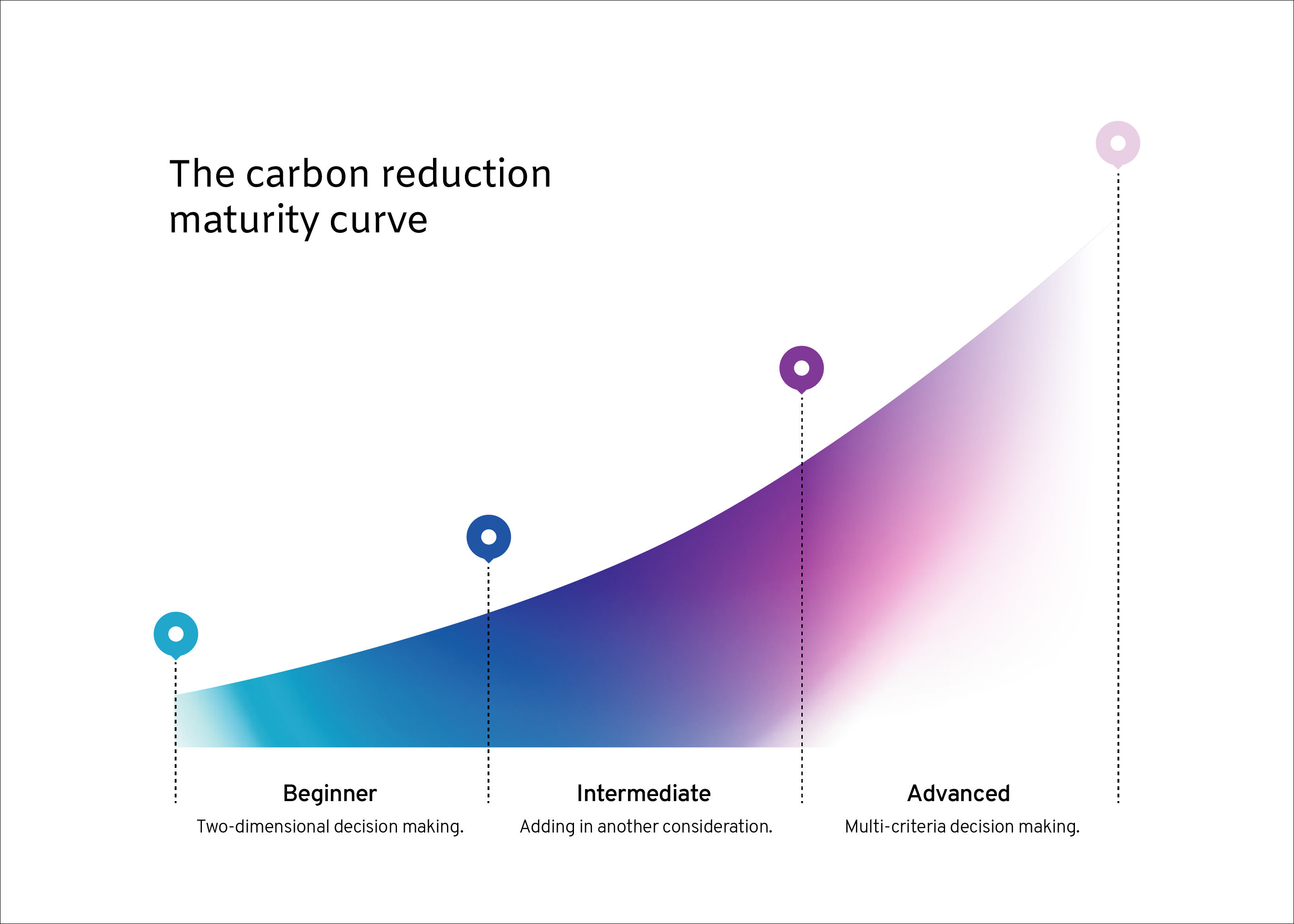

Make moves to understand how mature your existing decision making is in this area - where your place is on the carbon reduction maturity curve - and start from there. You can typically break it down into one of three levels of maturity.

Beginner

You’re making two dimensional decisions. Decisions based solely on a clear financial difference. Doing X costs me Y and delivers me Z.

Intermediate

You’re already adding in a new consideration, in this case carbon, alongside just providing a service. A non-financial value is already part of your decision making. This could be reflected in a simple, siloed way: should I replace all lightbulbs with LED? Should I invest in carbon offsetting to get to net zero goals? You’re including sustainable criteria, but you’re still making single criteria decisions.

Advanced

Very few organizations are advanced in their decision making, but the most mature, leading companies make multi-criteria decisions, where strategic thinking is clearly influenced by SDGs, and long-term choices are evidenced-based. These companies factor financial and non-financial benefits into decision making.

At this Advanced level of maturity, you might trade off a decision to invest in new IT hardware with a decision to invest in biodiversity. You could conclude that the overall, bottomline and societal benefit of biodiversity investment is greater than that of an IT upgrade - strategic thinking is evidence-based and organization-wide.

Of course, this level of advanced decision making depends on great data. And having - and critically using - decision support tools to read and respond to it. In and of itself, a mammoth undertaking, and digitalization should be all about agility. Organizations should look for more ‘chunkable’ technologies—asset management apps that digitize specific processes or target specific challenges. These apps bring data together in consistent, useful ways, and you can get to work with them quickly.

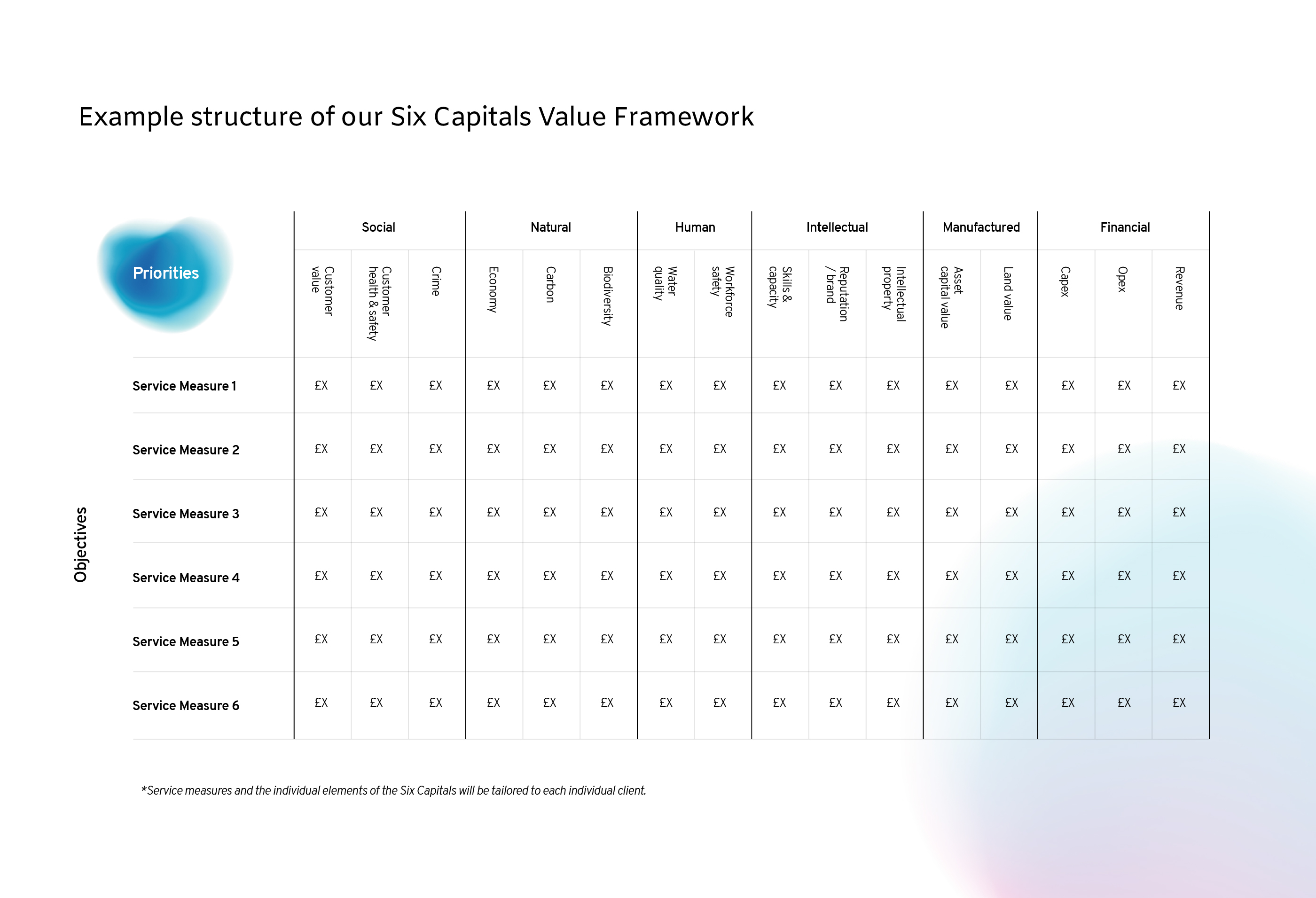

The rule of six

The Six Capitals (Value Framework) is key to understanding the long term, financial and non-financial value of investments—their true value. It helps you make choices that are most appropriate for the whole environment you’re operating within.

It shows you the wider implications of investments. In terms of sustainability, Natural Capital consideration is critical. It will typically encompass carbon accounting, and other elements, to highlight the environmental cost of CapEx and OpEx decisions.

Individual elements within the six capitals, the services measures (business objectives or customer requirements) placed against them, and the cost of each, are unique to each business. But once they’re quantified, you can optimize and re-optimize measures against each of these constraints, and see how dialing up or down one measure impacts another.

In terms of sustainability specifically, this might lead you to create, for example, a more sustainable drainage system—a path around a river, rather than a new concrete tank. Great sustainable value, but a really positive impact on the human and societal elements too, and the intellectual capital of the organization. You can read about our work with Yorkshire Water for some more practical insight.

ESG means thinking in circles

Circular processes for a circular economy — the continual use of resources to eliminate waste. While boardrooms need to make more public statements about Environmental, Social, and Corporate Governance (ESG) credentials, investors are also looking to confirm that ESG principles are thought through as part of an organization’s decision making process. They should be embedded from boardroom to operations, and back again.

Tactical asset management decisions around issues like waste minimization, resource optimization and reuse, and overall effectiveness, are key to proving and improving your credentials in the circular economy.

If you’re just starting out on your sustainability journey, start by spotting and fixing existing ESG inefficiencies. Targeted, sector-specific apps can help you use the resources you already have more effectively—minimizing waste and maximizing production efficiency. You don’t need to jump straight into company-wide initiatives and change management programs. Begin incrementally, one step at a time, and improve continuously.

Because irrespective of how good you are at ESG, there’s always more you can do.

Making change predictable

Learn how to truly transform your asset management processes by taking our Project Prioritizer tool.

Investment planning is a precarious balancing act for any organization. Throw in aging infrastructure, overall risk, consequences of failure, and the looming lost knowledge of an aging workforce, and you’ve got a perfect recipe for overthinking, indecision, and subjective decision making.

Digitalization is an important antidote to cure all of these ills. Crucially, improvements have been made to our infrastructure systems over the past four years.

The 2021 Report Card for America’s Infrastructure found the nation’s infrastructure earns a cumulative grade of a “C-.”Source

A robust, comprehensive dataset. Well-maintained, current. Consistently applied across every arm of an organization. It’s the Holy Grail. It empowers evidence-based decision making. It eliminates the fragmentation and inconsistency of disconnected decision making. It creates efficiencies that make organizations more competitive. And in the ‘do more with less’ environment we’re operating in, efficiencies are key. It provides a single source of trackable truth that can ultimately make processes more streamlined, resilient and connected.

So you know you need to digitalize, and digitalize you must. But where to start? You need the bones of an agile organization to start building value.

And that boils down to three key considerations. Reconnecting stakeholders across the business, creating a culture that everyone is bought into, and providing common tools and data to ensure everyone’s speaking the same language.

Read the digitalization action plan

Reconnect strategy and operations

We see a lot of disconnect from boardroom to the job site. It’s common, but doesn’t have to be inevitable. Putting processes in place to simply reconnect what’s going on operationally with what’s envisioned strategically can have a hugely positive effect. This can be as simple as visualizing and thereby revealing the strengths and weaknesses of control and mitigation measures.

One piece of analysis we at Gen previously carried out discovered an organization had a ‘governance meeting’ credited with mitigating $2.8bn of asset failure... that must have been an epic meeting! Revealing this vulnerability enabled more practical controls to be identified and disseminated.

Digitalizing processes naturally means everything is tracked, and can be more easily aligned to corporate goals. Using data to inform decision-making gives everyone from CEO to engineer access to the same insights, puts them on the same page, and ensures they’re working to a common goal. Workforce organization, driven by data, is key.

Often, organizations are operating on historic precedents. They’re reacting to issues or conforming to a static plan, and that’s how the workforce delivers tasks. There are incredible opportunities for efficiency to be found here: reacting is shown to cost somewhere between 3 and 8 times the overall cost of planning and being predictive.

Assess how you bring teams together and disseminate high level decisions, to work out what needs to be done, and who will do it. Getting those communications in place—daily, weekly, monthly—is a solid first step. Finding ways to automate them takes you further. Once a process is automated, it gathers data—and you can start making predictions.

We know how quickly and often you need to re-plan and reprioritize today. Having tools in place that let you quickly see the impact of resource reallocation means deploying maintenance teams rapidly, knowing they have the right information and tools, and are doing the right work at the right time.

And because the cost of being reactive is so much more than planning ahead, there are big savings to be achieved—between 10-40% depending on how disorganized you are in the first place!

Collect your data — bit by bit

Most organizations don’t hold data in a singular, accessible location. This is a problem. They lack the ability to examine consistent data across the business - it’s disparate, it’s unstandardized, and it has a big impact on communication and decision making.

This single issue is holding so many organizations back in their digital journey. Quantity and quality of data is seen as the most significant barrier to digitalization.

But every organization needs to start somewhere. And the good news is, you can start to make progress with what you’ve got. There’s a lot your existing data can tell you, even if it’s not the most mature dataset on the planet.

Getting value from the data you already have is the first step to more and better datasets overall—simply by collecting it together and starting to cleanse it—filling gaps, removing errors, eliminating inconsistencies.

To consider, as you take those first steps:

Get it together

Stop struggling with disparate spreadsheets. Hard to maintain individually, and impossible to easily combine. A perfect recipe for inaccuracies, inconsistencies, and data that gets old, fast.

Cloud-based software creates a common pool of information that is updated on every front every time an edit is made.

Access to field data is key. Mobile collection and maintenance enables organizations to realise the utility of data, keep it up to date, keep people safe and let them be effective in their roles.

Prioritize useful data

It can be difficult to know which data silo to tackle first. A good place to start is by prioritizing data collection that is most useful to corporate targets. Say your goal is carbon reduction, start with understanding how replacing or refurbishing assets will impact this. Do your replacements have net zero production targets?

Fill the gaps

Identify where your weak spots lie. Specific, targeted apps can help you visualize data, so you can see problematic areas very quickly and prioritize data collection in those areas.

Make assumptions

It is fair—and important—to make assumptions based on the best data you have available. If you have data on the age, design life, or installation of a pipe in one area, city plans can tell you how far to extend that information to nearby assets. Flag these assumptions for later validation.

Build and refine from there!

That means pulling data together from across the organization and putting in processes that will enhance it. Evolve maintenance processes so that when that one pipe is repaired, material and condition are noted and any assumptions made can be confirmed or updated.

Making change predictable

Our Project Prioritzer tool can help you to identify quick win projects within your business in just minutes.

Explore scenarios, consider restraints

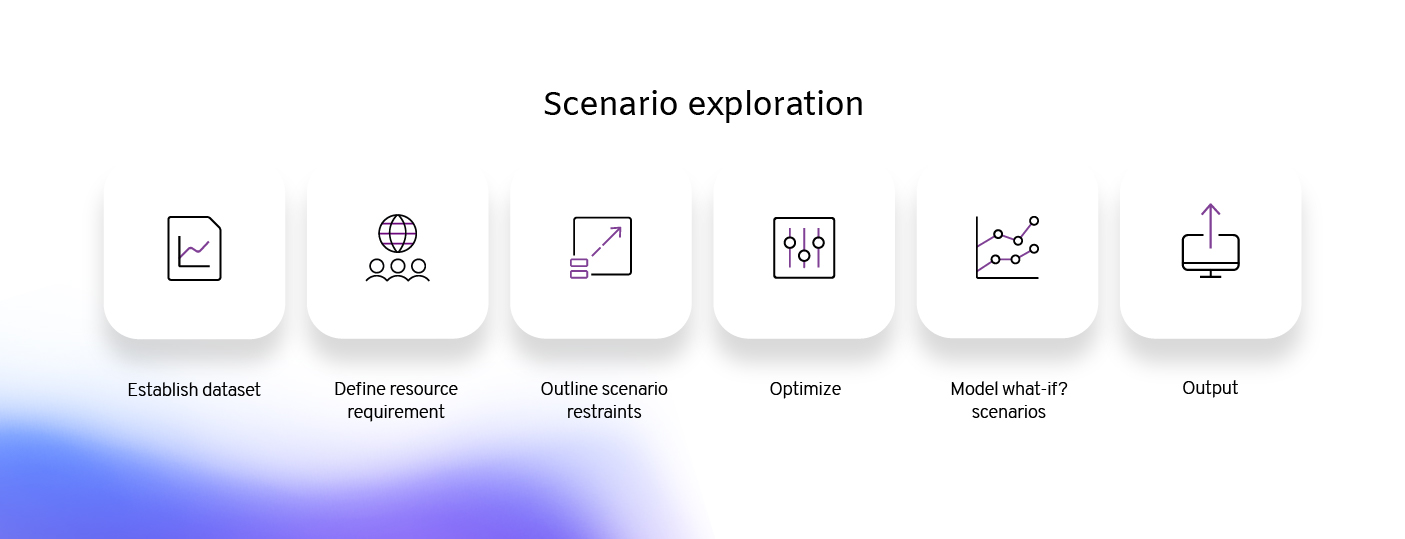

Now you’ve established your dataset, predictive analysis tools really come into their own. Your data’s just the first step—decision support tools built specifically for asset management companies can now really show organization-wide benefits.

Let’s take an example. You need to justify a set of investment options, with a target of carbon reduction. Our analysis shows that predictive analysis typically reveals c.20% of carbon efficiency savings, either in selecting a better mix of interventions or considering the order in which things are done.

- Once you’ve gathered and cleansed your data, you need to assess resources. Do you have the people to manage and support the targets? Will the supply chain manage?

- Then you can add your constraints. Do you have the budget? What is the timeframe?

- Of course, they’re all competing in different directions. So you optimize.

- Decision support tools will then let you model what-if? scenarios—compare pre- and post-investment outcomes.

- And finally—output and present. This is where a common data language shows real value—true evidence-based decision making and consistent thinking at every level.

Targeted asset management apps help you evolve incrementally by supporting each of these specific steps, making digitalization more manageable, more incremental.

And once you’ve taken those decisions into the real world, the beauty of digitalization is that you then get continuous feedback—and with it, opportunity for continuous organizational improvement.

The benefit of our experience

Why do we know so much about it? We’re the creators of AppliedInsight. It’s a suite of targeted asset management apps, specifically designed to overcome issue- and process-specific challenges. Watch our explainer video to find out more.

Create the culture

A big part of digitalization is cultural. There needs to be a recognition of the importance of data as an asset—one that needs maintaining in the same way as any other asset.

Big bang initiatives that collect and improve data quality without that understanding, or with no ongoing custodian, don’t work. Everyone needs to buy in to why you’re collecting data, and how to use it. Without this commitment, data very quickly becomes outdated, inaccurate, untrusted—and stops being used in decision making.

It’s important to build that mindset across each business unit, and the organization as a whole. Each user should know their role in the maintenance and use of data. Products with structured workflows encourage this, helping your teams understand what they need to do and when it needs to be done. You need to balance process, people, tech and data—none of those things in isolation will get you to the point of digitalization.

As the consumer experience has evolved, customers' expectations of infrastructure operators have evolved in tandem. At the same time, expectations from regulators, stakeholders and governments aimed at improving service levels and reducing costs are piling on more pressure.

Demands are increasing even when everything is going right, so when things do go wrong, it’s essential to recover service quickly, keep customers informed throughout, quickly learn lessons—and demonstrate what you’ve learned has been put into practice.

Savvy operators instinctively know they’re in the business of customer perception. Elite players know what their customers are thinking and exactly what to say to them. A million investment program could deliver significant service improvements. But if customers don’t know about the benefits, they’ll quibble when their bills go up a few dollars.

Keep customers happy by implementing tools that anticipate, avoid and mitigate the impact of outages. And maximize the efficiency of necessary maintenance. Use consistent data and planning to develop an effective communications strategy.

Read the customer perception action plan

Every face and facet

Customer perception is a team sport, everyone in an organization has a role to play and there’s no job too small to have an impact.

- At an operational level, you’re the face of the company when you visit a customer. How you present yourself has an impact on how that customer perceives you, and by extension, the company.

- At a portfolio level, your impact on customer perception lies at the community level. How you manage major projects—their social, environmental and economic impact. How maintenance is organized and carried out. How you consult locally and whether voices are heard.

- At board level, if you’re seen to be repeatedly doing harm to a community, that becomes a clear leadership issue. If this perceived harm is avoidable, then of course avoid it, but you can mitigate unavoidable reputational issues by dialling up commitments elsewhere. By carbon offsetting, for example, if the issue is environmental. Or through local employment schemes if a specific project is badly perceived.

You can change organizational responses to customers in micro ways, which still add up over time to a macro impact. Consider things like communication channels available to customers, the tone of voice used in communications, or project innovation that makes a proactive and positive impact on local environments. Where before you might have invested in large civil projects to mitigate flooding, consider natural flood management. Same endpoint, but how you get there makes all the difference. The Bay Park Conveyance Project in New York State provides a great example of proactive community engagement and what best practice looks like, even in the midst of a pandemic.

Quantify it

To truly understand and improve customer perception, you need to quantify it. You need to understand the value customers place on different service measures, so you can dial up and down accordingly.

Customer value frameworks do exactly this. They ask what’s important to customers, and quantify priorities by understanding the value placed on different service measures.

Taking a water company as an example—compare the customer perception impact of a pollution event or losing water to their home. A customer value framework measures how much value customers place on each. Having had that discussion, you can monetize customer perception, and link it back to investment decisions.

Think the unthinkable

Organizations understand risk management and risk assessment. However, understanding high impact, low likelihood events is more difficult. It’s easy to imagine a pump breaking or a pothole occurring in the road, it’s harder to imagine catastrophic failure, a cyber-security attack, or a natural disaster. But these incidents are becoming all the more familiar. From power outages in Texas, to flooding in Australia, they’re happening now, they’re highly public and while they can’t be predicted, they can be prepared for.

Organizations need to think about longer term hazards and threats, as well as immediate risks. They need to think about likelihood and consequence, and how prepared their assets are to cope. Here’s how.

Identify the issues

Use established frameworks such as the J100 framework to identify the range of hazards to plan for.

Consider the consequences

Next, consider the consequences of those hazards. What would a flood cause to fail? How would a natural disaster impact a certain plant?

Plan the response

Then, explore the variety of responses available. How are you going to recover? You might not be able to say when or where a catastrophic event will happen, but you can determine how to respond quickly, and how you’ll provide the best possible service to all impacted parties.

Identify your vulnerabilities

Build resilience into your systems. For example, you identify an area at particular risk of flooding, or an area with hard to manage vegetation—how do you invest to build resistance into that specific area of your system?

Seriously sweat the security

Digital security is ever more critical to customer perception. As data continues to proliferate and processes become more dependent on it, it will only gain importance.

In the US especially, there’s been a huge recent focus on security breaches and data penetrations. Customers are increasingly interested in how their own data is used and protected, as well as cybersecurity—and threats to it—more broadly.

Take the recent SCADA hack at a Florida water plant. One of the major issues cited in the breach was that the facility was running an “outdated Windows 7 operating system”. Critical infrastructure must be managed carefully. If someone can penetrate sensors, monitoring equipment, controls—they can adjust set points and change the environment. Consequences could be catastrophic.

Resilience assessment is critical to understanding how robust your control measures are, visualizing them for teams, customers and stakeholders, and planning improvements in the control environment. Improvements that might just keep you out of the headlines.

Some aspects to consider, depending on how you manage your asset data

Spreadsheets

Have vulnerabilities. They’re subject to human error, local access and lost laptops. How can you ensure absolute security in the hands of multiple end users?

Proprietary software

Business-built software can be well tailored to your organization’s unique needs, but, for any software that is hosted, you have to consider penetration testing, auditing, staying up to date with patches and updates, adhering to compliance as it evolves.

Third party tech

Third party tech lets you act and deploy quickly, because you don’t need to constantly test and secure your solution—your provider has taken care of it. Cloud-hosted solutions should be robustly tested, benefit from state-of-the-art security and remain constantly updated. Of course, ‘big tech’ is often too broad to be immediately beneficial, which is why it’s useful to look for more targeted, sector- and challenge-specific apps.

The benefit of our experience

Why do we know so much about it? We’re the creators of AppliedInsight. It’s a suite of targeted asset management apps, specifically designed to overcome issue- and process-specific challenges. Watch our explainer video to find out more.

Energy

Carbon reduction, resilience, risk exposure, and reputation

Read on for our overview of the big issues in asset management for water utilities, and the steps you can take to become more resilient, sustainable and efficient—in more manageable ways.

Less is more work

The global energy sector has a long road ahead to reduce emissions and risk exposure. Extreme weather events were responsible for half the loss of supply and two-thirds of the largest blackout events between 1984 and 2006. And that was just North America.

Renewable energy generation grew by just under 5% in 2020 and could soon account for a third of global output. However, there’s still a long way to go. According to The International Atomic Energy Agency, 80% of electricity generation will have to be overhauled to make energy fully green.

Energy players must also prioritize their investments to meet increasing demand, from optimizing solar panel and wind turbine placement to coordinating the massive infrastructure investments required to power the electric vehicle revolution.

Sustainability has become a strategic imperative. Larry Fink’s 2021 letter to CEOs called out the good economic sense of more sustainable decision making. Investors are increasingly looking for organizations to prove their green credentials.

As operations get more complex, an in-depth asset database is essential. How far can your system be stretched? Are you prepared to keep up and running in increasingly extreme environments? The more you know about your assets, the greater precision you can bring to ensuring resilience and responsiveness.

Read the sustainability action planFind out where you’re exposed

Assess your resilience by understanding the relationship between the probability of asset failure and the potential consequences. Capture as much relevant data as possible, including works management data, telemetry data, visual inspection data, cost data, etc. Use modeling to assess the health of your assets on metrics such as unplanned maintenance, mains bursting and interruptions to supply. Then predict how many assets are likely to fail over the next five to ten years. Factor in both planned and unplanned outages, particularly those caused by extreme weather events and seismic activity. (Don't forget less dramatic but common hazards such as vegetation.)

Once you understand the probability of an asset failing, consider the consequences—everything from a temporary outage to loss of life. Then allocate budgets according to your risk tolerance.

Interrogate the future

If you can figure out your assets' current status, you can predict how they will be performing in 10 years. And what investments you need to make now to meet demand. Your degree of confidence depends on the quality of your data, but more importantly, what you do with it.

Asset optimization models let you evaluate long-term environmental risks against other key areas, such as financial and network performance.

- Once you’ve established the data you have to use, you need to assess resource. Do you have the people to manage and support the targets? Will the supply chain manage?

- Then you can add your constraints. Do you have the budget? What is the timeframe?

- Of course, they’re all competing in different directions. So you optimize.

- Decision support tools will then let you model what-if? scenarios—compare pre- and post-investment outcomes.

- And finally—output and present. By analysing and comparing multiple what-if? scenarios, you can present multiple futures, showcase financial and non-financial benefits, and provide clear, evidenced rationale for the decisions made along the way to achieving them.

Carbon reduction is hot air without data

How will your next investments impact your current carbon footprint? Have you factored in embedded carbon as well as operational carbon? What does renewable energy asset management look like for your organization? Where are the quick wins, and what can you achieve over the next 5–10 years? These are complex questions that require sophisticated analysis. Find technology that will help you crunch the data to take practical steps to reduce emissions or divest assets into renewables. Typical areas of focus include rolling stock, manufacturing, water used in production, and how energy itself is generated, distributed, and used. Once you've developed a plan of action, use the data to streamline your execution.

Prioritize capital, operational, and maintenance interventions to reduce your total risk profile and meet increasing demand.

Find out where you’re exposed

The grid is creaking. In the UK, the gap between available capacity and maximum system demand has shrunk from around 20% to just over 1%. The story is the same elsewhere: Increasing demand gives energy providers less room for maneuvering. And a future filled with extreme events demands they move now.

So what can energy players do about it, short of $billions of investment and turning back the clock on climate change? Choose evolution over transformation. Modernization requires data-driven, modular solutions. Get to know the grid better with targeted tools and apps that will let you monitor and analyze assets one stage at a time, ultimately building a comprehensive picture of the power at hand.

Many providers have already shown what’s possible. Florida Power & Light prevented an outage for 15,000 customers and avoided $1 million in restoration costs by identifying and repairing a transformer before it failed. Digitalization is an endless journey towards ultimate efficiency and resiliency. While you’ll never be done, it’s easier to get started than you think.

Read the digitalization action planThere’s always enough data

Do you have the bare minimum of data to take action now? Almost certainly. Establish your baseline and work from there. Even with just a few datasets, you can start asking the right questions to understand how multiple factors affect everything from individual assets to network-wide performance. "If X, then what happens to Y?" will take you far.

There are many quick wins to be had by incorporating readily available third-party data and expertise, such as failure data, engineering logic, manufacturers' guidelines, and so on. For example, GIS data allows you to visualize your assets on a map and see how they interact with roads, buildings, natural features and their proximity to other assets. This is powerful information for grouping synergistic activity onsite with all grouping of asset work, and minimizing disruption to citizens.

Data collection costs time and money. You want it to pay off. So apply statistical analysis or readily available data, such as manufacturer's guidelines, to make some intelligent assumptions about the current and future status of your assets. That will help you to focus your data collection efforts in the right places. Then you can confirm or revise your initial assumptions to deepen your understanding.

Making change predictable

Take our Project Prioritizer tool to receive bespoke guidance on how to enhance your data management.

Dismantle data silos

Your organization has a wealth of knowledge that’s not on spreadsheets. It’s in individual heads. Those heads are connected to bodies. And bodies have a habit of walking out the door, often to competitors or retirement. When they leave, so does their knowledge.

Extract that value. Get experts to upload their insights as a matter of course. Encourage your capital and maintenance teams to talk to each other and coordinate capital interventions with maintenance ones. For example, making sure you're not maintaining something that's just been replaced or vice versa.

Expect a degree of resistance but push on. It can be as simple as setting up a monthly planning call and ensuring different departments review the same metrics. Before you know it, you're transitioning from institutional or individual judgment calls to evidence-based decisions. From boardroom to jobsite, eliminating fragmented decision making and siloed knowledge will generate value through and for the whole organization.

Use tech to make everyone's lives easier

If you're encouraging colleagues to share what they know, make it as seamless as possible. Running multiple spreadsheets is inefficient, hard to manage, and prone to human error. Get a single location for your data. Move from scattered silos to unified data-capture and coordinated decision-making.

Use tools with simple user interfaces such as dashboards with drill-down capabilities. Ensure all information and changes are tracked and auditable, including updates to scenarios, constraints, and data. Combine formal training courses and 'on the job' training to ensure your team quickly gains the desired skills to create, run and make changes to their models as needed.

The efficiencies and improvements generated by better use of tech will ultimately drive better corporate performance by giving you the insights you need to create robust, data-driven asset investment plans.

You don’t have to do everything at once. Use what you’ve got to determine your first move, then hone in with ever greater precision.

The benefit of our experience

Why do we know so much about it? We’re the creators of AppliedInsight. It’s a suite of targeted asset management apps, specifically designed to overcome issue- and process-specific challenges. Watch our explainer video to find out more.

What they see is what they forget

The energy sector literally powers the world. But energy providers are rarely applauded for doing their job. Customers only really notice when the lights go out – or their bills go up. And energy providers are under increasing pressure to justify their fees, both from regulators and the people that pay them. Meanwhile, demand keeps rising along with the risk of outages, damage, and accidents caused by extreme events.

All energy providers are in the business of customer perception. Savvy operators know this instinctively. Elite players know what their customers are thinking and exactly what to say to them. Proactively alerting customers to outages, for instance, has been shown to increase overall customer satisfaction by 24 points. Similarly, customer satisfaction is 20% higher when energy providers are seen to be maintaining current infrastructure. A million dollar investment program could deliver significant service improvements. But if customers don't know about the benefits, they will quibble when their bills go up a few dollars.

Keep customers, and subsequently shareholders, happy by implementing tools that anticipate, avoid and mitigate the impact of outages and maximize the efficiency of necessary maintenance. And use joined-up data and planning to develop an effective communications strategy.

Read the customer perception action planCustomer perception is everyone’s job

Every member of your organization has an impact on customer perception. From the delivery of a major project in the community to how an operative interacts face-to-face with a customer. It all counts.

Non-financial reporting continues to grow in the US. Ask your customers what’s important to them. Expand the conversation beyond service and pricing and truly understand what they value as customers. Many in the UK water industry are using Social Capitals (Value Framework) thinking to assess the value customers place on wider social and environmental impact. It allows qualification and analysis of asset management in order to prioritize projects for maximum positive impact. Or avert the biggest threats to reputation. Not only that, but it becomes a means to close the loop with your customers and explain the choices that you have made on their behalf and the rationale behind those choices.

This is a relatively sophisticated approach, bringing together the accounting and finance world along with social and behavioural economics. The public sector is a key adopter and is able to drive considerable benefit. However, the American Association of CPAs is starting to get more involved and adopting this thinking too. So, how do you accelerate your organization’s journey? Working with Yorkshire Water, for example, we provided long-term resilience through detailed uncertainty and sensitivity analysis, saving roughly £4 for every £1 spent.

For energy utilities, the CNAIM framework provides a useful place to start, in informing these conversations and understanding the value customers place on social and environmental impact. It will help to quantify the Consequences of Failure (CoF) for specific assets, so reputational damage can be assessed accordingly.

"For an individual asset, the CoF associated with the asset is driven by the localised situation of the asset. For example, the Network Performance impact will be driven by the number of customers, or amount of load, that is affected by failure of the asset. Similarly, the environmental impact may be dependent on the proximity of the asset to an environmentally sensitive area (such as a watercourse)."

When Gen worked with Evonet, one of the leading Distribution System Operators in Scandinavia, we used an adaptation of the Common Network Asset Indices Methodology (CNAIM) to use available information and data to calculate and forecast risk for Extra-High Voltage (EHV) assets.

Remember that no matter how good your intentions or actions, they won't affect customer perception unless your customers hear about them. There are numerous ways to get noticed for the right things – whether it's a tweak to your tone of voice on social media or announcing a major new green initiative. The destination is the same; how you get there is up to you.

Prioritize spending to deliver customer value

As with any business, your primary goal should be to deliver the best possible service (while satisfying shareholders and regulators, of course). For energy companies, that means meeting demand and ensuring supply resilience while spending money as wisely as possible. You may have a limited budget, but there is no limit to the insights you can glean from your data. Replan and keep optimizing. Balance your network and budget constraints and understand how you've changed impact on delivery. That's the only way you will improve.

Get a handle on your unique risk profile. Location, in particular, can have a dramatic effect on the criticality of otherwise identical assets. Operators in North America and Australia, for instance, are more concerned about the fire risk of electricity poles than their UK-based counterparts. Likewise, a pole going down in a field is not the same as another crashing into a hospital. However, both events will trigger identical alerts unless you've linked your asset database to updated GIS data. (In which case, you've probably already moved the hospital much higher on your proactive maintenance regime to prevent the event from happening in the first place.)

Minimize downtime and make maintenance go further

No customer enjoys an interruption to their power supply. But notifying them about planned downtime in advance is preferable to apologizing after the fact for unplanned outages, especially if you're cutting the power now to reduce the chance of it happening without warning in the future.

Once you know which assets need attention, you can estimate the time and cost of replacements, refurbishments, and maintenance. Then plan and replan to action them as quickly and cost-effectively as possible while keeping the long-term in mind.

You can save a lot of time and money by 'bundling' as many interventions as possible into a single circuit or substation at the same time. This allows you to reduce the number of site visits. Sometimes it pays to fix things that can wait. If you've already planned a visit for something more urgent, it's often better to carry out additional maintenance while you're there rather than scheduling an ad hoc visit later.

Do you need that new transmitter? If you can predict when an asset will fail, you can decide if it’s more cost-effective to replace now or simply maintain.

Water

Carbon reduction, resilience, risk exposure, and reputation

Read on for our overview of the big issues in asset management for water utilities, and the steps you can take to become more resilient, sustainable and efficient—in more manageable ways.

Every drop counts

3.6 billion people live in areas that are water-scarce for at least one month each year. As demand increases along with global temperatures, 5.7 billion could be at risk by 2050.

Water companies cannot solve climate change alone. But they can be part of the solution, taking manageable steps to reduce carbon emissions while investing in projects that benefit both people and the environment. And, crucially, tackling wastage. Alignment to ESG principles doesn’t just make good environmental sense, it makes good economic sense too, as evidenced by Larry Fink’s 2021 letter to CEOs.

For example, in the United States, aging and degraded assets are to blame for 240,000 water pipe breaks every year. Combined with inadequate capacity, failing assets exacerbate water scarcity while discharging around 900 billion gallons of untreated sewage and causing some 5,500 illnesses each year.

Read the sustainability action planThink from water supply to wellbeing

The United Nations’ Sustainable Development Goals (UNSDGs) acknowledge that sustainability isn't just about protecting the environment—it's also about enabling human flourishing. Your customers don't care about CapEx and OpEx. They care about how your investments impact their lives, their communities, and the environment.

Don't just approach problems from an accounting and engineering perspective. Apply Six Capitals (Value Framework) thinking: How will your next investment add value to society and the natural world, as well as to your shareholders? If you push yourself to do something you haven’t done before, what learnings could you apply to future projects?

The Six Capitals will help you understand the long term, financial and non-financial value of investments—their true value. In terms of sustainability, Natural Capital consideration is critical. It will typically encompass carbon accounting, and other elements, to highlight the environmental cost of CapEx and OpEx decisions, so you can be sure you’re getting the most value from your budgets.

No utility provider wants to make extreme weather events more likely, so it's a given that asset management for water utilities should aspire to net-zero carbon. That's not going to happen overnight. But every step brings you closer. Begin by understanding how your organization uses carbon—then you can figure out what to cut, offset or eliminate altogether.

Solve multiple problems at the same time

On a tactical level, sustainable asset management for water utilities is about minimizing waste, extracting maximum value from your resources, and improving your operations' overall effectiveness. It’s about creating value for customers, regulators and shareholders, all at the same time. Broaden your mindset, and the possibilities overflow.

Instead of using a concrete tank to store peaks in storm flows, why not create a sustainable drainage system to slow the flow, while increasing the local amenity value? Can you make a closed-loop system that reuses by-products to power the processes which created them? Will you incinerate biosolids, use microbes to harvest their energy, or use them as fertilizer?

Plan for the best by prioritizing the worst

Reducing carbon emissions across operations might help to reduce the likelihood of extreme weather events, but it won't prepare your infrastructure for the next 100-year storm or flood. Or prevent assets from failing tomorrow.

Existential threats are out of your control, but operational degradation is something you can manage, that can mitigate the consequences of extreme events when they do happen. Take an asset by asset approach and tackle management one step at a time. In water, you might begin by identifying the above or below-ground assets that are most likely to fail.

Advanced analytics, targeted at specific asset types, can help you predict and optimize risk levels, move from reactive to proactive asset management, and maximize the value of capital investments, while making the most of the assets you have in place. You can also plan budgets, better - because a clearer idea of asset performance means more accurate forecasting.

You can better use the data you have to reduce environmental impact while increasing resilience.

Eye-watering numbers

Aging infrastructure and insufficient investment are creating a looming crisis in the water sector. If current consumption trends persist, there will be $195 billion of outstanding works in 2040 – and that's just in the United States.

Inaction is not an option. Innovation is essential for the global water sector to reduce the price tag of aging assets. In lieu of substantial CapEx boosts, operational evolution can arm organizations against unpredictability and OpEx spikes. And it begins with data.

Digitalization provides a clearer view of the current—and future—status of infrastructure. Water companies can leverage data together with increasingly sophisticated modeling to preempt and prevent issues, shift from reactive to proactive maintenance, and develop strategic business plans to improve cross-asset performance.

Digitalization requires smart thinking and smart technologies. And it's easier than you think. You don't need to be a data scientist to make data-driven decisions. Water companies can adopt an incremental approach and drive process improvements right now.

Read the digitalization action planBuild a centralized asset database

How do you capture, store and organize your data? Relying on multiple spreadsheets to manage different assets is often inefficient, insecure, and prone to human error. Consolidate your existing data by moving to a cloud-based SaaS asset management platform. This will make it easier to input and analyze data across your portfolio while keeping information current across your entire asset register, preventive maintenance regimes, corrective maintenance, labor workforce, and asset-related supply chain.

Just centralizing and cleansing data can create huge efficiencies and add value at every level of your organization. Evidence-based decision making is critical. It puts everyone on the same page and ensures consistency between strategy and operations, so you can have dynamic discussions, make decisions more quickly, and respond rapidly to changing influences.

Leverage your existing data while improving it

Don’t worry if you’re missing data. Advanced analytics and AI can plug some gaps immediately, while you focus on filling the rest. Capture data that allows you to understand the overall performance and service levels of an asset – not just its structural integrity. When there has been an issue, find out which zipcode reported it, and why did the asset actually fail? You don't need perfect data to take positive action. If you wait until you've collected everything, you'll never get anything done. Accept there will be uncertainty and make progress with what you’ve got, but use AI to understand the range of uncertainty.

Making change predictable

Learn how to truly transform your asset management processes by taking our Project Prioritizer tool.

Connect strategic direction with operational reality

Digitalization allows utilities to break away from static or reactive maintenance plans, bring teams together, and optimize their activities on a quarterly, monthly, and even daily basis. There are up to 40% savings available from applying data-driven insights to workforce management. However, expect some initial resistance. Digitalization requires an organization-wide shift in mindset before it becomes business-as-usual. Collaboration is essential. Data and analytics are worthless without people working together to apply the insights they contain. Overcome disconnected decision-making by creating a consistent, two-way relationship between strategy and operations. Everyone should value and maintain data like they would any critical asset. And know why they’re using it in the first place. (It helps if they’re using intuitive, accessible platforms that they trust.)

Digitalization is a continuous process, not a single event. Don’t wait for perfect data. You’ll be surprised what you can achieve now.

Don’t let trust evaporate

The public expects a certain level of service when it comes to water quality and delivery. Increasingly, customers don't just care about the service they receive; they also worry about resilience to climate change. People want to be reassured that water isn't being wasted.

For example, in the United States, water scarcity is a major concern for 69% of customers. 74% agree more needs to be done in their communities to conserve this most precious of all resources. Meanwhile, unreliable water and wastewater infrastructure are expected to cost US households and businesses $616 billion between 2011–2040.

No customers are campaigning for rates to go up – certainly not without clear benefits in return. So water companies have to spend their money more wisely than ever. Fortunately, technology allows you to prioritize and optimize work on the assets that pose the biggest threat to customer perception – increasing resilience against more extreme weather events and helping to sustain expected levels of service and value.

Read the customer perception action planPut customer outcomes first

Talk to your customers. And listen to what they're saying about you online. Quantify how much they value your services, including your influence on the environment and the community. And, crucially, how they feel when there's a negative event, such as a leakage or interruption of service.

Once you've got this framework in place, you can attribute a monetary value to customer perception and use it to inform your investment decisions. Analyze customer perception alongside your pricing and asset database to determine your risk exposure across your portfolio – and the potential reputational impact should an asset fail. That should make it easier to identify the assets that need immediate attention.

Use the right tools for the job

Every sector is different, as is every asset. Water infrastructure asset management is unique. So, use tech built on algorithms and analytics tools that have been tailored to specific challenges. Model each asset individually for tactical insights, then pull the data together for strategic projects and cross-asset optimization. Assess portfolio-level performance across the key metrics that impact customer perception and model 'what-if' scenarios to inform your cost-benefit analysis for each investment and intervention.

The benefit of our experience

Why do we know so much about it? We’re the creators of AppliedInsight. It’s a suite of targeted asset management apps, specifically designed to overcome issue- and process-specific challenges. Watch our explainer video to find out more.

Resilience must be proactive

Some events are highly unlikely but, potentially, catastrophic. In 2015, an unexpected event prevented the supply of drinkable water to over 300,000 homes in England's northwest. This cost millions of pounds and impacted the provider's relationship with customers. It's difficult to analyze rare events like this after the fact because there usually aren't any historic data points to provide context. But they reinforce the importance of a proactive approach.

Assess resilience 'in the round' – beginning with the assets themselves and the number of customers at risk. Play to everyone's strengths. Ask site managers to rate assets on key criteria such as scale of impact, duration of impact, likelihood and vulnerability, and convert the results into a resilience score. Visualize the key takeaways so board members can move from assumptions and capital-led solutions to evidence-based decisions. Now you can manage interventions, including social media and public relations campaigns, for maximum effect.

Quantify what impacts customer perception. Then prioritize the most cost-effective actions to avert crises and protect your reputation.

Resilience should also be considered from an operational and financial perspective.

- Do you have contingencies in place that assure you’re a sustainable long-term business?

- Have you considered corporate resilience? Human capital, training, cyber security?

Organizations need to understand threats and hazards within these many and varied facets, and develop responses based on threat and likelihood.

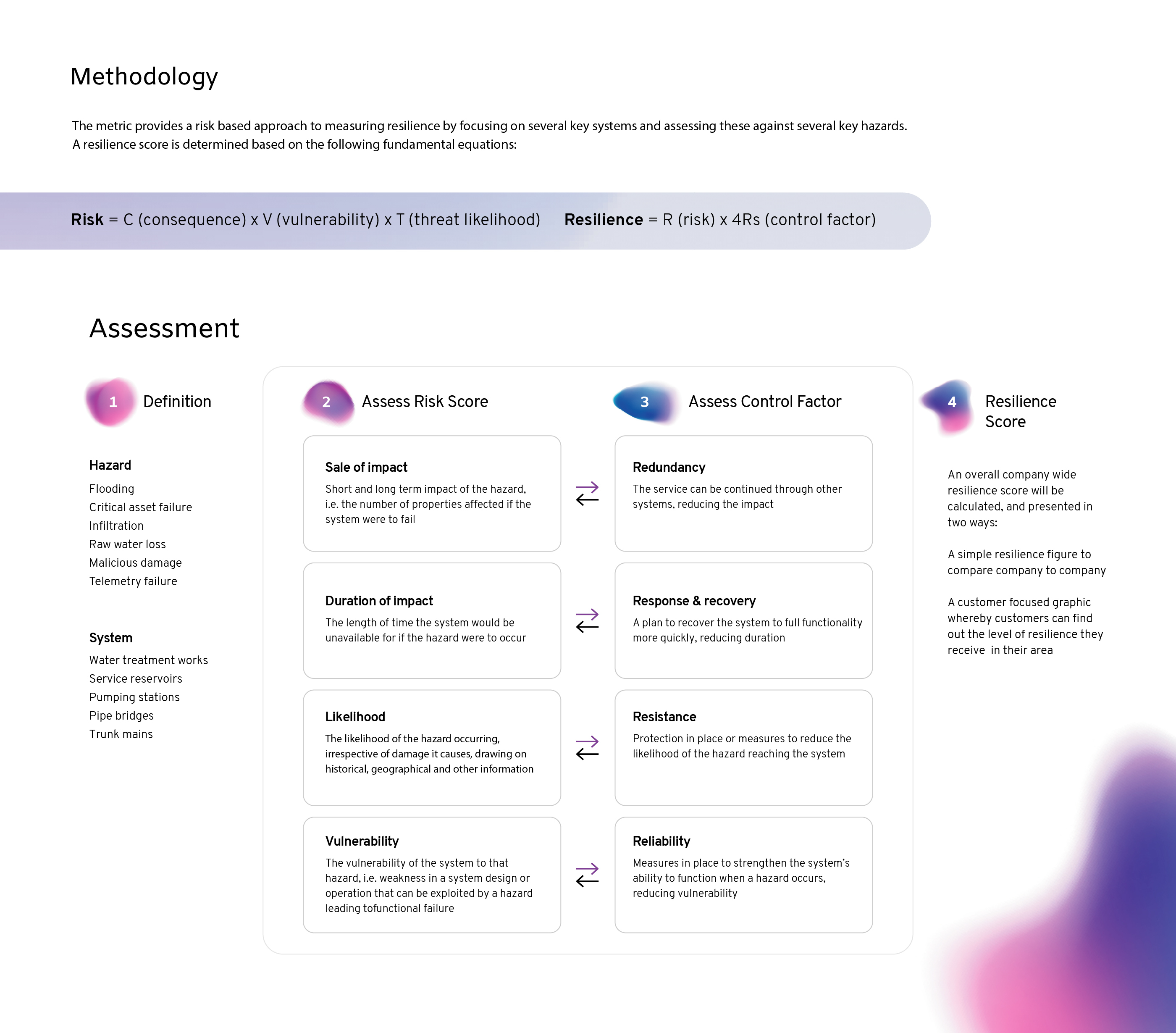

Take a look at this work from United Utilities, a UK-based water company, which proposes a common resilience metric for the industry. It creates measures to indicate whether the population is served by satisfactorily resilient services, by employing a risk based resilience assessment. It focuses on common critical hazards and drives improvement over time across the 4Rs of resilience: Resistance, Reliability, Redundancy, Response & Recovery. This tool has been used to assess thousands of facilities, has identified CapEx savings and secured additional funding to improve the resilience of systems across the UK.

Introducing AppliedInsight

We created AppliedInsight to solve specific problems like these. It’s a suite of targeted asset management apps, specifically designed to overcome issue- and process-specific challenges. Learn more about our water apps here.

We promise an easier approach to analytics.

Arcadis Gen combines deep, long-established engineering expertise, with digital, fit-for-future technology.

AppliedInsight is a suite of targeted asset management apps, specifically designed to help you overcome issue- and process-specific challenges within your sector.